PCI Compliance Simplified for Tattoo Studio Owners

Introduction

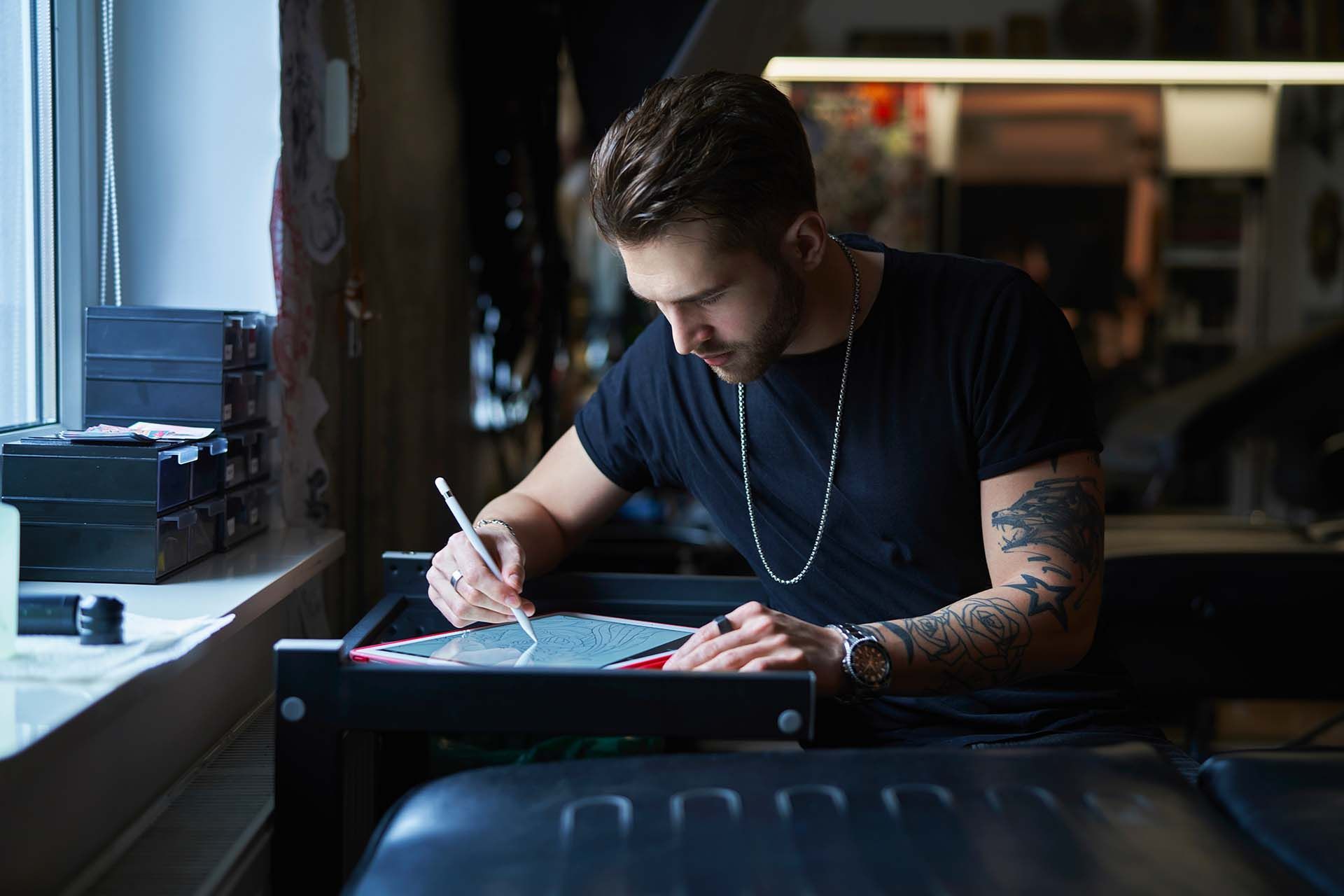

As a tattoo studio owner, you pour your creativity and passion into every piece of art you create. But running a successful studio isn't just about the ink—it's also about managing the business side, which includes handling payments securely. If you've recently received a notice from your payment processor about Payment Card Industry (PCI) compliance and felt a wave of confusion or stress, you're not alone.

Understanding PCI compliance is crucial for protecting your clients' sensitive information and maintaining the reputation of your studio. This guide breaks down what you need to know in straightforward terms.

For a more detailed article on PCI compliance for small business owners with more specific recommendations, click here.

What Is PCI Compliance?

PCI compliance refers to following the Payment Card Industry Data Security Standard (PCI DSS). These are a set of security protocols designed to ensure that any business accepting credit card payments maintains a secure environment. The goal is to protect cardholder data and reduce credit card fraud.

Why It Matters for Your Tattoo Studio

Handling Payments

In your studio, you might accept payments in various ways: in person after a session, over the phone for deposits, or online through appointment bookings. Each method involves transmitting and potentially storing your clients' credit card information. Even jotting down card details on a piece of paper counts as storing sensitive data and falls under PCI compliance requirements.

Building Client Trust

Your clients trust you not just with their skin but also with their personal information. Protecting their payment data is part of providing a professional and secure service. A breach of this trust can have serious repercussions for your studio's reputation.

Key Steps to Achieve PCI Compliance

Use Secure Payment Methods

- In-Studio Transactions: Ensure your point-of-sale (POS) system is up-to-date and PCI-compliant. Devices should use encryption to protect data during transactions.

- Online Bookings and Deposits: Use a secure, PCI-compliant payment gateway on your website. This ensures that card information entered online is protected.

Avoid Storing Card Data

- Minimize Records: Do not keep physical copies of credit card numbers or store them digitally on unsecured systems.

- Secure Disposal: If you need to write down card details temporarily, destroy the information securely after use—shred paper documents and permanently delete digital files.

Keep Your Systems Updated

- Software Updates: Regularly update your POS software, computers, and any devices used for processing payments to protect against security vulnerabilities.

- Antivirus Protection: Install reputable antivirus and anti-malware software on all devices involved in payment processing.

Train Your Team

- Employee Awareness: Educate your staff on the importance of handling customer data securely. This includes proper use of payment systems and recognizing suspicious activities.

- Establish Protocols: Create clear procedures for processing payments and safeguarding information. Ensure everyone knows what to do and what not to do.

Consult Professionals if Needed

- IT Support: Consider hiring an IT specialist familiar with small businesses and PCI compliance to assess your current systems and recommend improvements.

Potential Consequences of Non-Compliance

- Financial Penalties: Non-compliance can result in hefty fines ranging from thousands to tens of thousands of dollars.

- Legal Issues: If a data breach occurs, you could face lawsuits from affected clients.

- Reputation Damage: A breach of trust can lead to negative reviews and loss of future business, which is particularly damaging in an industry built on personal referrals and reputation.

Next Steps

Achieving PCI compliance doesn't have to be a daunting task. Start by evaluating how your studio currently handles credit card information and identify areas that need improvement. Implementing secure payment methods and training your team are significant steps toward compliance.

Protecting your clients' data not only meets legal requirements but also enhances your studio's credibility. Clients will appreciate knowing that their personal information is safe with you, which can set your studio apart in a competitive market.

For a comprehensive guide with detailed steps, read our full article here.

Note: This summary provides general information and should not be considered legal or professional advice. For specific guidance, consult a PCI compliance expert or your payment processor.

Disclaimer: This publication and the information included in it are not intended to serve as a substitute for consultation with business consultants and professionals. Specific business, financial, legal issues, concerns and conditions always require the advice of appropriate professionals. Any opinions expressed are solely those of the participant and do not represent the views or opinions of this company.